Part 1: Introduction to Investing

Investing is a powerful tool that allows individuals to grow their wealth over time. Unlike saving, which typically involves setting aside money in a low-risk, low-return environment, investing involves putting money into assets with the potential for higher returns. The goal of investing is not only to preserve capital but also to generate income or achieve capital gains.

Part 2: Why Invest?

- Growth Potential: Investing offers the potential for significant growth. Over time, investments in assets such as stocks, real estate, and mutual funds can yield substantial returns, outperforming traditional savings accounts.

- Inflation Hedge: Inflation erodes the purchasing power of money. Investing in assets that appreciate in value can help counteract the effects of inflation.

- Financial Goals: Whether it’s for retirement, buying a home, or funding education, investing helps in achieving long-term financial goals.

- Passive Income: Investments such as dividend-paying stocks, real estate, and bonds can provide a steady stream of passive income.

Part 3: Saving vs. Investing – Pros and Cons

Saving

Pros

- Safety: Savings accounts are generally low-risk. Your principal is protected, especially in insured accounts.

- Liquidity: Savings are easily accessible and can be withdrawn without penalty.

- Simplicity: Saving requires little to no knowledge of financial markets.

Cons:

- Low Returns: Savings accounts typically offer lower returns compared to investments. The average annual interest rate for savings accounts in Europe ranges from 0.01% to 0.5%.

- Inflation Risk: The interest earned on savings may not keep pace with inflation, leading to a loss of purchasing power over time.

Investing

Pros

- Higher Returns: Investments have the potential to yield higher returns than savings accounts.

- Growth of Capital: Through investments, your money can grow significantly over time.

- Diversification: Investing allows you to spread risk across different asset classes.

Cons:

- Risk of Loss: Investments come with the risk of losing some or all of the invested capital.

- Complexity: Investing requires a certain level of knowledge and understanding of financial markets.

- Time Commitment: Successful investing often requires time to study and monitor investments.

Part 4: Types of Investments and Expectations

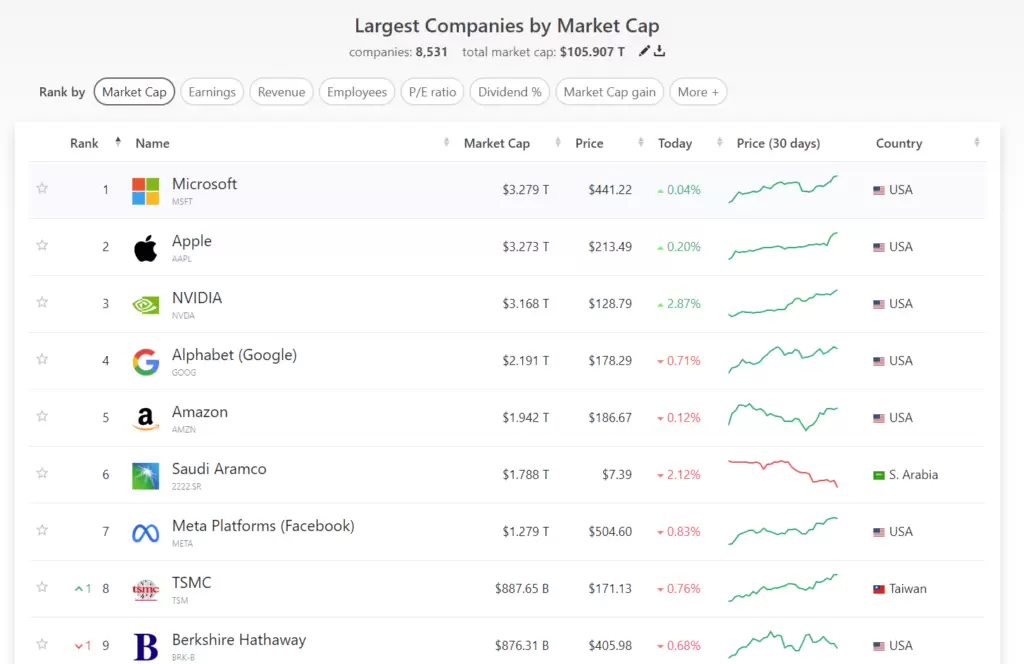

Stocks

Stocks, also known as equities, represent ownership in a company. When you purchase a stock, you buy a share of that company, making you a shareholder. This ownership entitles you to a portion of the company’s profits and assets, proportional to the number of shares you own.

| Aspect | Details |

|---|---|

| What Are They? | Ownership shares in a company, entitling shareholders to a portion of the profits. |

| Types of Stocks | Common, Preferred, Growth, Value, Blue-Chip, Penny |

| Risks Involved | Market risk, volatility risk, company-specific risk |

| Price Determinants | Company performance, economic indicators, market sentiment, industry trends, external factors |

| Average Yield | Historically 7-10% per year |

| Pros | High return potential, dividends, ownership, liquidity |

| Cons | High volatility, market risk, time-consuming, emotional stress |

| Mastery Requirements | Education, staying informed, strategy development, use of analytical tools, diversification |

Types of Stocks

- Common Stocks: Most prevalent type of stock that provides voting rights and dividends.

- Preferred Stocks: Offer fixed dividends and have priority over common stocks in the event of liquidation but usually do not come with voting rights.

- Growth Stocks: Companies expected to grow at an above-average rate compared to other companies.

- Value Stocks: Companies that appear to be undervalued in the market.

- Blue-Chip Stocks: Large, well-established companies with a history of reliable performance.

- Penny Stocks: Low-priced stocks of small companies, often highly speculative and risky.

The Risk Involved

- Market Risk: The potential for investors to experience losses due to factors that affect the overall performance of the financial markets.

- Volatility Risk: The degree of variation in a stock’s price over time, which can lead to significant gains or losses.

- Company-Specific Risk: Risks related to the specific company, such as poor management, product recalls, or legal issues.

What Determines a Stock’s Price?

- Company Performance: Profits, revenue, and growth prospects.

- Economic Indicators: Inflation, interest rates, and economic growth.

- Market Sentiment: Investor perceptions and market trends.

- Industry Trends: Changes within the industry the company operates in.

- External Factors: Geopolitical events, natural disasters, and other external shocks.

Average Yield Per Year

Historically, stocks have returned about 7-10% per year on average, though this can vary significantly based on the market conditions and specific stocks.

Pros of Stock Investments

- High Return Potential: Stocks generally offer higher returns compared to other investments over the long term.

- Dividends: Many stocks pay dividends, providing regular income.

- Ownership: Shareholders have voting rights and a say in company decisions.

- Liquidity: Stocks are easily bought and sold on the stock market.

Cons of Stock Investments

- High Volatility: Stock prices can fluctuate widely, leading to potential losses.

- Market Risk: Stocks are affected by market conditions and economic factors.

- Time-Consuming: Requires ongoing monitoring and research.

- Emotional Stress: Market swings can lead to stress and emotional decision-making.

Mastering Stock Investments

To become proficient in stock investing, you need to:

- Educate Yourself: Learn about financial statements, stock analysis, and market indicators.

- Stay Informed: Keep up with market news, economic reports, and company announcements.

- Develop a Strategy: Have a clear investment strategy and stick to it.

- Use Analytical Tools: Utilize fundamental and technical tools

- Diversify: Spread investments across different sectors and companies to mitigate risk.

Commodities

Commodities are physical goods such as gold, oil, agricultural products, and metals that are traded on global exchanges. Investors can buy and sell these commodities directly or through futures contracts.

| Aspect | Details |

|---|---|

| What Are They? | Physical goods traded on global exchanges, including metals, energy, agriculture. |

| Types of Commodities | Precious metals, energy, agricultural, industrial, livestock |

| Risks Involved | Price volatility, lack of income generation, sector-specific risks |

| Price Determinants | Supply and demand, geopolitical events, weather conditions, currency movements |

| Average Yield | Historically varies widely; Gold: Had 8.86% average return over the last 20 years |

| Pros | Diversification, inflation hedge, global demand, tangible assets |

| Cons | Price volatility, no income generation, storage costs, complex market dynamics |

| Mastery Requirements | Understanding market fundamentals, monitoring economic indicators, assessing geopolitical risks, technical analysis, logistics evaluation |

Types of Commodities

- Precious Metals: Gold, silver, platinum, palladium.

- Energy: Crude oil, natural gas.

- Agricultural: Corn, wheat, soybeans.

- Industrial: Copper, aluminum, steel.

- Livestock: Cattle, hogs.

The Risk Involved

- Price Volatility: Commodities prices can fluctuate significantly due to supply-demand imbalances, geopolitical factors, and weather conditions.

- Lack of Income Generation: Unlike stocks or bonds, commodities generally do not provide income through dividends or interest.

- Sector-Specific Risks: Each commodity type has unique risks related to its supply chain, geopolitical sensitivity, and regulatory changes.

What Determines a Commodity’s Price?

- Supply and Demand: Changes in production, consumption patterns, and inventories.

- Geopolitical Events: Wars, sanctions, political instability affecting production or transportation.

- Weather Conditions: Natural disasters impacting agriculture or energy production.

- Currency Movements: Commodities are often priced in US dollars, so currency fluctuations can affect prices.

Average Yield Per Year

Commodities can vary widely in terms of yield. Historically, gold has averaged around 1-2% per year over the long term, while other commodities can experience higher volatility and returns during certain market conditions.

Pros of Commodities Investments

- Diversification: Commodities can act as a hedge against inflation and currency devaluation.

- Inflation Hedge: Prices of certain commodities tend to rise during inflationary periods.

- Global Demand: Commodities are traded globally, offering exposure to international markets.

- Tangible Assets: Investors own physical goods, providing a sense of security.

Cons of Commodities Investments

- Price Volatility: Commodities prices can be highly volatile, leading to potential losses.

- No Income Generation: Most commodities do not generate regular income like dividends or interest.

- Storage Costs: Physical commodities require storage, which can incur additional expenses.

- Complex Market Dynamics: Understanding global supply chains and demand factors is crucial.

Mastering Commodities Investments

To become proficient in commodities investing, you need to:

- Understand Market Fundamentals: Learn about supply-demand dynamics and global factors influencing commodity prices.

- Monitor Economic Indicators: Stay informed about economic trends, inflation rates, and currency movements.

- Assess Geopolitical Risks: Analyze geopolitical events impacting commodity-producing regions.

- Consider Technical Analysis: Use charts and technical indicators to identify trends and entry/exit points.

- Evaluate Storage and Transport Costs: Understand logistics and associated costs for physical commodities.

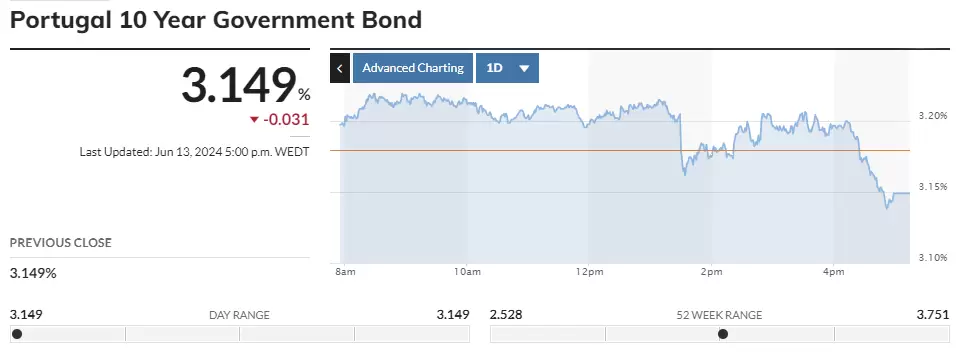

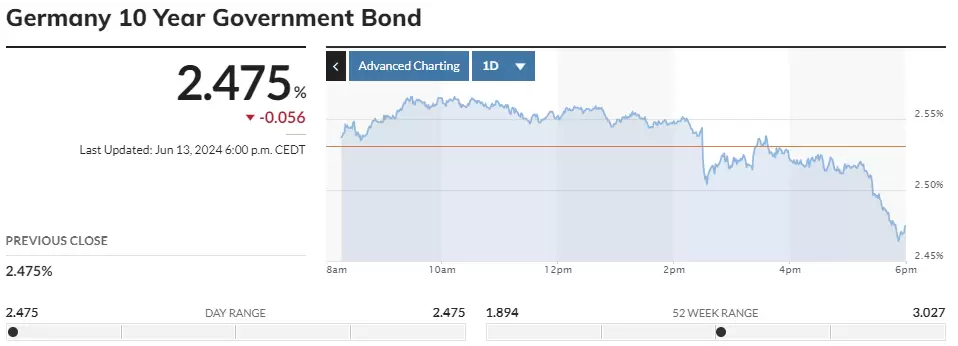

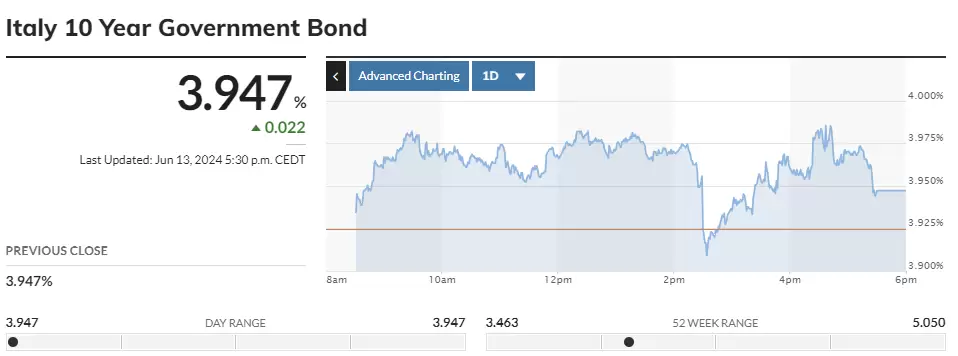

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you purchase a bond, you lend money to the issuer in exchange for periodic interest payments (coupons) and the return of the principal amount at maturity.

| Aspect | Details |

|---|---|

| What Are They? | Debt securities issued by European governments, municipalities, or corporations for raising capital. |

| Types of Bonds | Government, Municipal, Corporate, High-Yield, Eurobonds, Inflation-Linked |

| Risks Involved | Credit risk, interest rate risk, inflation risk, currency risk, liquidity risk |

| Price Determinants | Interest rates, credit rating, time to maturity, inflation expectations, market demand |

| Average Yield | Govt: 0-2% annually, Corp: 2-5% annually, High-Yield: 5-8%+ annually |

| Pros | Steady income, lower risk, diversification, capital preservation |

| Cons | Lower returns, interest rate risk, credit risk, inflation risk |

| Mastery Requirements | Understanding bond metrics, monitoring economic indicators, diversification, credit risk assessment, staying informed |

Types of Bonds in Europe

- Government Bonds: Issued by European national governments, such as German Bunds or French OATs.

- Municipal Bonds: Issued by local governments or municipalities within European countries.

- Corporate Bonds: Issued by European companies to finance operations, expansions, or acquisitions.

- High-Yield Bonds (Junk Bonds): Corporate bonds with lower credit ratings, offering higher yields but higher risk.

- Eurobonds: Bonds issued in a currency not native to the country where it is issued, widely used in Europe.

- Inflation-Linked Bonds: Adjusted for inflation, such as UK Index-Linked Gilts or French OATi.

The Risk Involved

- Credit Risk: The risk that the issuer may default on interest payments or fail to return the principal.

- Interest Rate Risk: The risk that rising interest rates will reduce the market value of existing bonds.

- Inflation Risk: The risk that inflation will erode the purchasing power of future interest payments.

- Currency Risk: For bonds issued in foreign currencies, exchange rate fluctuations can impact returns.

- Liquidity Risk: The risk that bonds may not be easily sold in the market without significant price concessions.

What Determines a Bond’s Price?

- Interest Rates: Inversely related; when interest rates rise, bond prices fall and vice versa.

- Credit Rating: Bonds with higher credit ratings are perceived as less risky and have higher prices.

- Time to Maturity: Longer-term bonds are more sensitive to interest rate changes.

- Inflation Expectations: Higher expected inflation can reduce bond prices.

- Market Demand: Supply and demand dynamics in the bond market.

Average Yield Per Year

- European Government Bonds: Typically yield 0-2% per year.

- European Corporate Bonds: Can yield 2-5% per year.

- High-Yield Bonds: Offer higher returns, usually 5-8% or more, but come with increased risk.

Pros of Bonds Investments

- Steady Income: Regular interest payments provide predictable income.

- Lower Risk: Generally lower risk compared to stocks, especially for government bonds.

- Diversification: Bonds can diversify an investment portfolio and reduce overall risk.

- Capital Preservation: Bonds can help preserve capital while providing returns.

Cons of Bonds Investments

- Lower Returns: Typically offer lower returns compared to stocks.

- Interest Rate Risk: Rising interest rates can lead to losses in bond prices.

- Credit Risk: Possibility of issuer default, particularly with lower-rated bonds.

- Inflation Risk: Fixed interest payments may not keep up with inflation.

Mastering Bonds Investments

To become proficient in bond investing in Europe, you need to:

- Understand Bond Metrics: Learn about yield, duration, and credit ratings.

- Monitor Economic Indicators: Keep an eye on interest rates, inflation, and economic policies within the Eurozone.

- Diversify: Spread investments across different types of bonds and issuers to mitigate risk.

- Assess Credit Risk: Evaluate the creditworthiness of bond issuers, considering the economic stability of European countries.

- Stay Informed: Keep up with market trends and news affecting European bond markets.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) are investment funds that are traded on stock exchanges, much like stocks. ETFs hold assets such as stocks, bonds, or commodities and aim to track the performance of a specific index, sector, commodity, or asset class.

| Aspect | Details |

|---|---|

| What Are They? | Investment funds traded on stock exchanges that hold a basket of assets. |

| Types of ETFs | Equity, Bond, Commodity, Sector, International, Inverse, and Leveraged |

| Risks Involved | Market risk, tracking error, liquidity risk, counterparty risk, currency risk |

| Price Determinants | Underlying asset performance, supply and demand, tracking accuracy, market sentiment, economic indicators |

| Average Yield | Equity: 5-10% annually, Bond: 1-5% annually, Commodity: Variable |

| Pros | Diversification, lower costs, liquidity, transparency, flexibility |

| Cons | Market risk, tracking error, trading costs, dividend treatment, complexity |

| Mastery Requirements | Understanding ETF structures, monitoring economic indicators, diversification, performance analysis, staying informed |

Types of ETFs

- Equity ETFs: Track a specific stock index like the FTSE 100 or the DAX 30.

- Bond ETFs: Invest in government or corporate bonds.

- Commodity ETFs: Track the price of commodities like gold, oil, or agricultural products.

- Sector and Industry ETFs: Focus on specific sectors like technology, healthcare, or energy.

- International ETFs: Invest in markets outside of Europe, such as emerging markets or global indexes.

- Inverse and Leveraged ETFs: Aim to deliver multiples of the performance (positive or negative) of an index.

The Risk Involved

- Market Risk: ETFs are subject to the same market risks as their underlying assets.

- Tracking Error: The performance of the ETF may not perfectly match the index it tracks.

- Liquidity Risk: Some ETFs may have low trading volumes, making them harder to buy or sell at desired prices.

- Counterparty Risk: For synthetic ETFs, there is a risk that the counterparty providing the underlying asset exposure could default.

- Currency Risk: ETFs that invest in foreign assets may be affected by exchange rate fluctuations.

What Determines an ETF’s Price?

- Underlying Asset Performance: The value of the assets within the ETF determines its price.

- Supply and Demand: Market demand for the ETF itself can influence its price.

- Tracking Accuracy: How closely the ETF tracks its underlying index.

- Market Sentiment: Investor perceptions and broader market trends.

- Economic Indicators: Factors like interest rates, inflation, and economic growth.

Average Yield Per Year

- Equity ETFs: Can yield similar returns to their respective indexes, typically 5-10% per year.

- Bond ETFs: Yield varies based on the types of bonds held, generally 1-5% per year.

- Commodity ETFs: Highly variable; depends on the specific commodity.

Pros of ETFs Investments

- Diversification: ETFs provide exposure to a broad range of assets within a single investment.

- Lower Costs: Typically have lower expense ratios compared to mutual funds.

- Liquidity: ETFs can be bought and sold throughout the trading day on stock exchanges.

- Transparency: Holdings are usually disclosed daily.

- Flexibility: Wide variety of ETFs available to meet different investment strategies.

Cons of ETFs Investments

- Market Risk: ETFs are subject to market volatility and risks associated with their underlying assets.

- Tracking Error: Potential discrepancy between ETF performance and its index.

- Trading Costs: Frequent trading can lead to additional brokerage fees.

- Dividend Treatment: Dividends are usually not immediately reinvested, which can impact compounding.

- Complexity: Some ETFs, especially leveraged and inverse ETFs, can be complex and risky.

Mastering ETFs Investments

To become proficient in ETF investing in Europe, you need to:

- Understand ETF Structures: Learn about different types of ETFs and how they are structured.

- Monitor Economic Indicators: Keep an eye on interest rates, inflation, and economic policies within the Eurozone and globally.

- Diversify: Use ETFs to achieve a diversified investment portfolio.

- Analyze Performance: Evaluate the performance and tracking error of ETFs.

- Stay Informed: Keep up with market trends and news affecting ETF markets.

Forex Investments

Forex, or foreign exchange, is the global market for trading national currencies against one another. The forex market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion.

| Aspect | Details |

|---|---|

| What Is It? | The global market for trading national currencies. |

| Types of Transactions | Spot, Forward, Futures, Options, Swap |

| Risks Involved | Exchange rate risk, leverage risk, interest rate risk, country risk, liquidity risk |

| Price Determinants | Interest rates, economic indicators, political stability, market sentiment, trade balances |

| Average Yield | Variable; skilled traders may aim for 10-20% annually but with significant risk |

| Pros | High liquidity, 24/5 market, leverage, diverse opportunities, global exposure |

| Cons | High risk, complex market, emotional stress, high costs, regulatory risk |

| Mastery Requirements | Education, trading plan development, use of analytical tools, staying informed, discipline |

Types of Forex Transactions

- Spot Market: Immediate exchange of currencies at the current market rate.

- Forward Market: Agreements to exchange currencies at a future date at a predetermined rate.

- Futures Market: Standardized contracts traded on exchanges to buy or sell currency at a future date and price.

- Options Market: Contracts that give the buyer the right, but not the obligation, to exchange currency at a specific rate on or before a certain date.

- Swap Market: Agreements to exchange currency between two parties at a specific date and rate, followed by a reversal of the transaction at a later date.

The Risk Involved

- Exchange Rate Risk: The risk of fluctuating currency values.

- Leverage Risk: Forex trading often involves high leverage, amplifying both gains and losses.

- Interest Rate Risk: Differences in interest rates between two currencies can affect exchange rates.

- Country Risk: Economic, political, and social instability in a country can impact its currency.

- Liquidity Risk: Some currency pairs may have low liquidity, leading to larger price movements and potential losses.

What Determines a Currency’s Price?

- Interest Rates: Higher interest rates offer lenders better returns relative to other countries, increasing currency value.

- Economic Indicators: GDP growth, employment rates, and manufacturing output influence currency strength.

- Political Stability: Stable political environments attract foreign investment, boosting currency value.

- Market Sentiment: Investor perceptions and speculative actions can impact currency demand.

- Trade Balances: A country with a trade surplus will generally see its currency appreciate.

Average Yield Per Year

The forex market doesn’t have a standardized yield like other investment vehicles. Returns vary based on trading strategies, market conditions, and individual skill levels. Successful forex traders may aim for annual returns in the range of 10-20%, though this involves significant risk and skill.

Pros of Forex Investments

- High Liquidity: The forex market is highly liquid, allowing for quick and easy trades.

- 24/5 Market: Trading is available 24 hours a day, five days a week.

- Leverage: Traders can use leverage to control larger positions with smaller amounts of capital.

- Diverse Opportunities: Numerous currency pairs provide a variety of trading opportunities.

- Global Exposure: Forex trading offers exposure to global economic conditions.

Cons of Forex Investments

- High Risk: The potential for significant losses due to leverage and market volatility.

- Complex Market: Requires a deep understanding of global economics and market dynamics.

- Emotional Stress: Constant market monitoring can be stressful and lead to emotional decision-making.

- High Costs: Spreads, commissions, and overnight fees can add up, impacting profitability.

- Regulatory Risk: Changes in regulations can affect market access and trading conditions.

Mastering Forex Investments

To become proficient in forex trading in Europe, you need to:

- Educate Yourself: Gain a thorough understanding of forex markets, trading strategies, and economic indicators.

- Develop a Trading Plan: Create and stick to a well-defined trading plan with risk management strategies.

- Use Analytical Tools: Utilize technical analysis tools, charts, and economic calendars.

- Stay Informed: Keep up with global news, economic reports, and market trends.

- Practice Discipline: Maintain discipline and avoid emotional trading decisions.

Part 5: How to Get Started

Investing requires careful planning and execution. Here are some steps to get started:

- Set Clear Goals: Define your financial objectives and investment goals.

- Assess Risk Tolerance: Understand how much risk you are willing to take.

- Educate Yourself: Invest time in learning about different investment options.

- Create a Diversified Portfolio: Spread your investments across different asset classes to reduce risk.

- Monitor and Adjust: Regularly review your investment portfolio and make adjustments as needed.

Part 6: Investing in Europe with IronFX

IronFX is a recommended broker for European investors. Here’s why:

- Wide Range of Investment Options: IronFX offers access to various financial instruments, including stocks, forex, commodities, and indices.

- User-Friendly Platform: Their platform is designed to cater to both beginners and experienced investors.

- Regulation and Security: IronFX is regulated by multiple authorities, ensuring the safety of your investments.

- Educational Resources: They provide extensive educational materials to help you understand the market and make informed decisions.

- Customer Support: IronFX offers robust customer support to assist you with any queries or issues.

Part 7: Conclusion

Investing is crucial for building wealth and securing your financial future. By understanding the differences between saving and investing, exploring various investment options, and leveraging reliable brokers like IronFX, you can embark on a successful investment journey. Remember, the key to successful investing lies in continuous learning, disciplined approach, and patience.