KEY TAKEWAYS

- The Federal Reserve is widely expected to maintain its influential interest rate at its current 23-year-high level when officials make policy decisions on Wednesday.

- Inflation moderated in the second quarter and the job market has continued softening, factors that will likely encourage the Fed to cut interest rates in the coming months.

- Market participants widely expect the Fed will start cutting the fed funds rate in September, and they’ll be looking for the central bank to provide signals next week about the timeline for cuts.

Lower interest rates are on the horizon, but they’re probably not here just yet.

Officials at the Federal Reserve are widely expected to hold the central bank’s key interest rate steady when they meet next Wednesday. Despite some economists saying July is the right time to cut, financial market participants priced in an outside chance Friday—just 4.7%, according to the CME Group’s FedWatch tool, which forecasts rate movements based on fed funds futures trading data.

Inflation reignited in the first quarter, but has since continued its descent, Friday’s report on the Federal Reserve’s preferred measure of inflation showed. Some economists said the central bank will hold one more meeting to ensure inflation won’t reaccelerate.

“But with growth slowing and unemployment already creeping higher, the economy seems to be increasingly vulnerable, and an additional exogenous shock—such as a spike in geopolitical conflict or a selloff in equity and credit markets—could tip the economy over the edge,” wrote Moody’s Analytics Economist Justin Begley.

“Keeping rates this high for too long could meaningfully damage the labor market and further shake business and consumer confidence, all of which would be bad for personal income,” he wrote.

Will Fed Officials Signal a September Rate Cut?

Those factors could lead the Federal Open Market Committee to be more explicit about whether it will cut the fed funds rate at its subsequent meeting in September, as observers widely expect.

In recent speeches, Fed officials have said they’re encouraged by data showing inflation has fallen steadily in recent months, but that they’re waiting for more data before committing to cutting rates.

“We expect the Fed to keep its policy rate unchanged in July while signaling progress on reducing inflation has resumed,” Michael Gapen, chief U.S. economist at Bank of America Securities, wrote in a commentary. “The Fed is optimistic that cuts are likely in the near term, but we do not think it is willing to signal September is a done deal. It could happen, but it would depend on the data.”

A Cut Would Be A Turning Point For Economy

Should the Fed hold rates steady on Wednesday, September’s meeting could be a turning point in the Fed’s battle against inflation.

It would be the first reduction in interest rates since the onset of the pandemic in 2020. The Fed held the rate at near zero during the pandemic to stimulate the economy with easy money, then ratcheted it up beginning in March 2022 to slow the economy and stifle inflation.

In July 2023, the Fed raised the fed funds rate to its highest since 2001 and has held it there ever since.

Over the past two years, the annual inflation rate as measured by the Personal Consumption Expenditures (PCE) price index has fallen to an annual rate of 2.5% from its recent peak of 7.1%, nearing the Fed’s goal of 2%. At the same time, the formerly red-hot labor market has cooled down, with the unemployment rate ticking up to 4.1% from the 50-year low of 3.4% it hit last year.

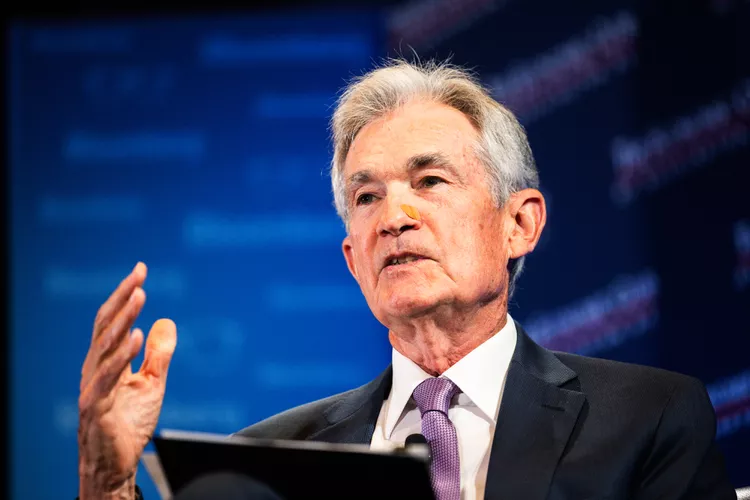

Notably, Fed chair Jerome Powell has said he’s become equally concerned about the job market as he is about inflation, suggesting that the Fed could soon start shifting away from inflation-fighting mode. The Fed uses monetary policy to pursue its congressional mandate to keep inflation under control and the unemployment rate low.