KEY TAKEAWAYS

- The Federal Reserve’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) index, will be released Friday. The inflation data and a slew of other indicators during the week will be closely watched amid hopes that continued indications of sluggish economic activity could spur the Fed to cut interest rates.

- Several Federal Reserve officials are scheduled to comment after last week’s interest rate decision and updated economic forecasts.

- Other notable earnings on the schedule for this week include Nike, FedEx and Walgreens.

Market watchers have been looking for more signals that inflation is falling, amid hopes that a continued decline in price pressures will spur the Federal Reserve to cut interest rates. They’ll get a key reading on Friday with the release of the May Personal Consumption Expenditures (PCE) index, which is the Fed’s preferred gauge of inflation.

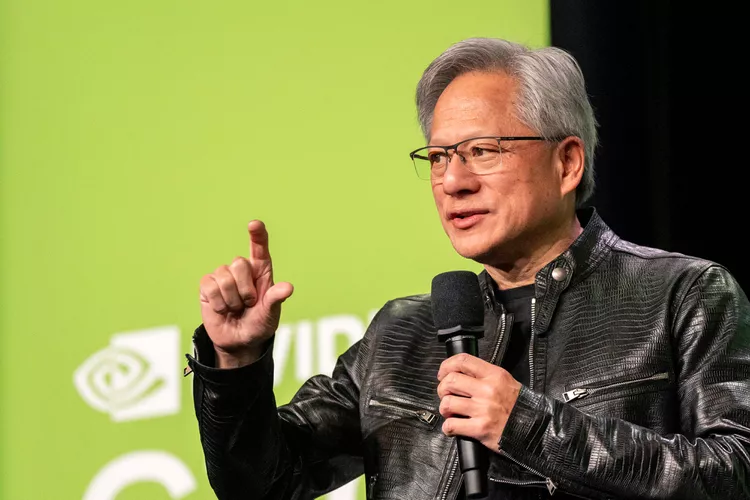

Investors will also get updates on the artificial intelligence marketplace when Nvidia (NVDA) hosts its annual shareholder meeting, Micron Technology (MU) releases earnings and Salesforce (CRM) holds its shareholder meeting.

Nike (NKE), FedEx Corp (FDX), Walgreens Boots Alliance (WBA), General Mills (GIS) and Levi Strauss & Co. (LEVI) are among other companies scheduled to report quarterly financial results this week.

Monday, June 24

- San Francisco Fed President Mary C. Daly delivers remarks

Tuesday, June 25

- S&P CoreLogic Case-Shiller home price index (April)

- Consumer confidence (June)

- Federal Reserve Govs. Michelle Bowman and Lisa D. Cook deliver remarks

- FedEx Corp (FDX) and Carnival Corp (CCL) report earnings

Wednesday, June 26

- New home sales (May)

- Nvidia (NVDA) annual shareholder meeting

- Micron Technology (MU), Paychex, Inc. (PAYX), General Mills, Inc. (GIS), Jefferies Financial Group (JEF) and Levi Strauss & Co. (LEVI) report earnings

Thursday, June 27

- Initial jobless claims (Week ending June 22)

- Advanced international trade in goods (May)

- Advanced wholesale inventories (May)

- Advanced retail inventories (May)

- Pending home sales (May)

- Durable goods orders (May)

- Gross domestic product – third revision (Q1)

- Salesforce (CRM) shareholder meeting

- Nike, Inc. (NKE), Walgreens Boots Alliance (WBA) and McCormick & Company (MKC) report earnings

Friday, June 28

- Personal Consumption Expenditures (PCE) price index (May)

- Consumer sentiment (June)

- Chicago Business Barometer (June)

- Richmond Fed President Tom Barkin delivers remarks

Watching PCE for Signs of Improvement on Inflation

Market watchers will be paying close attention to several data releases this week to see if it indicates a continued slowdown in economic activity and easing of inflationary pressures.

Friday’s release of the Personal Consumption Expenditures (PCE) index for May will be particularly closely watched as it is the Fed’s preferred gauge of inflation. Central bankers want to see more signs that inflation is falling before cutting interest rates, which are at two-decade highs.

The April PCE reading showed prices rose 2.7% year-over-year, in line with expectations, but still ahead of the Federal Reserve’s target of 2%. Since then, a tamer Consumer Price Index (CPI) inflation reading for May has raised hopes that inflation is continuing to cool.

On Thursday, the third revision to first-quarter gross domestic product (GDP) will be released. The most recent revisions downgraded economic growth to 1.3%.

Nvidia Shareholder Meeting, Earnings from Micron, FedEx, Nike Highlight Corporate Calendar

Investors will hear from some of the leading companies in the growing AI marketplace this week.

Nvidia executives will host the chipmaker’s annual shareholder meeting on Wednesday. The meeting comes as the chipmaker’s rise in share price has pushed its market value to more than $3 trillion as the company capitalizes on interest in its AI products.

Market watchers will hear from another chipmaker this week when Micron Technology delivers its quarterly earnings report on Wednesday, following an upgrade from Bank of America on optimism for its AI products. AI will likely also be a topic at the Salesforce shareholder meeting on Thursday. The software company delivered worse-than-expected guidance for the second quarter, despite its focus on driving growth through AI products.

Shipping giant FedEx will report earnings on Tuesday after it announced a $5 billion stock buyback program during its last quarterly report. Shoemaker Nike’s earnings report on Thursday follows weak guidance last quarter, even as the company prepares a marketing blitz during the upcoming Summer Olympic Games.