Nvidia (NVDA) stock rose on Tuesday after Foxconn, the world’s largest contract electronics manufacturer, touted strong demand for artificial intelligence servers.

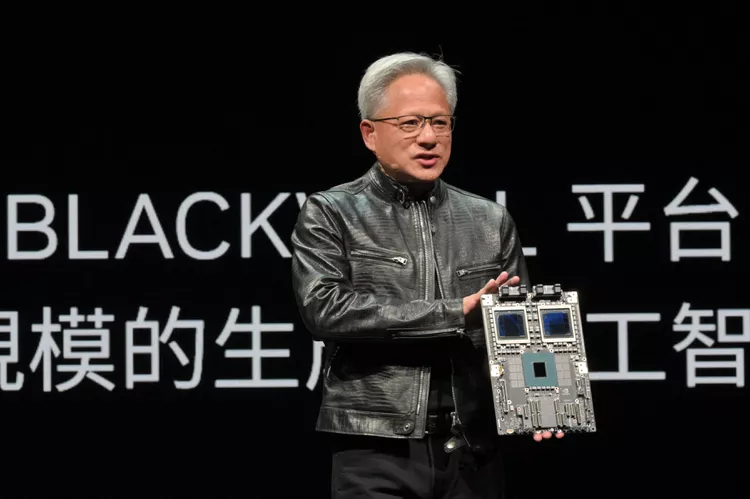

Nvidia (NVDA) shares surged on Tuesday after Foxconn, the world’s largest contract electronics manufacturer, announced strong demand for AI servers. During its annual tech day, Foxconn revealed it is constructing the world’s largest AI server assembly facility in Mexico, which will use Nvidia’s GB200 chips, part of the Blackwell AI architecture.

Foxconn’s chairman, Young Liu, told Bloomberg Television that the company plans to produce 20,000 GB200 NVL72 servers at this new facility by 2025. HSBC analysts estimate the price of each GB200 NVL72 server at approximately $3 million. Foxconn’s senior VP of cloud enterprise solutions, Benjamin Ting, noted that demand for Nvidia’s Blackwell system is “awfully huge,” with Liu adding that the demand is “crazy,” echoing similar remarks made by Nvidia CEO Jensen Huang.

Nvidia Surpasses Microsoft in Market Value

Nvidia’s stock rose over 4% on Tuesday, building on gains from the previous day when the company overtook Microsoft (MSFT) as the second-most valuable company in the U.S. The stock closed just under $133, approaching its record high of $135.57 set in June, with an all-time intraday high of $140.76.

Nvidia shares have more than doubled in 2024, despite a brief slump during the summer due to reports of a design flaw that could delay the Blackwell system rollout. This slowdown coincided with a broader tech sell-off, as disappointing earnings raised concerns about excessive AI spending. Nonetheless, Nvidia’s dominance in the AI sector has continued to drive its stock higher.