The U.S. labor market report published today has completely altered the market outlook. This week’s data has been quite favorable for the Federal Reserve, which has maintained its stance and continued to indicate a desire for interest rate cuts this year. Today’s data likely delays the timeline for these cuts, though upon deeper analysis, some inconsistencies can be noted.

Strong Job Growth

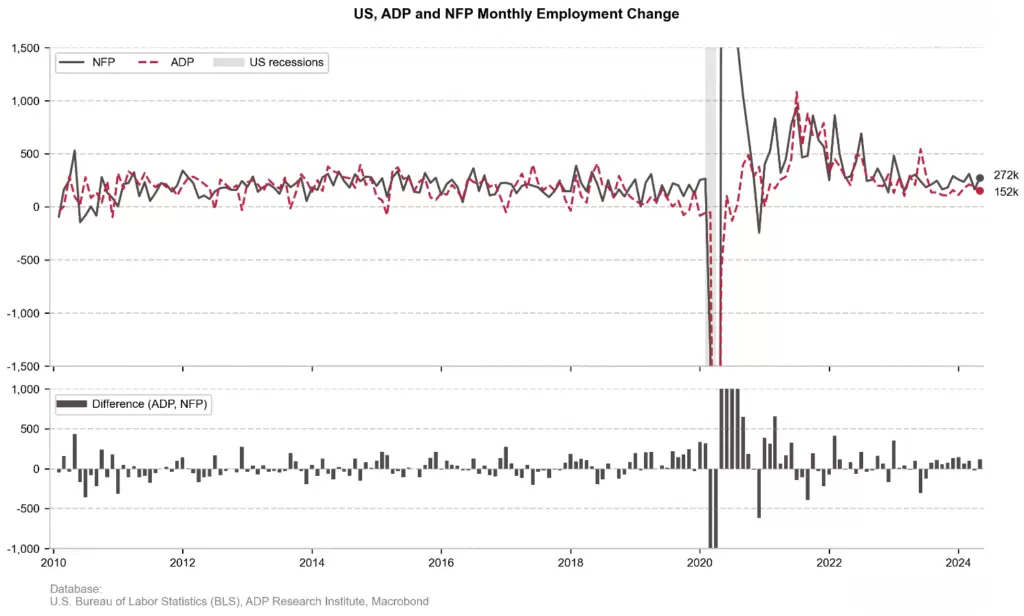

Non-farm employment increased by 272,000. Today’s reading was almost 100,000 higher than the market consensus, which projected a reading of 175,000. This is also significantly more than the ADP report. The NFP reading below the ADP for April was an outlier, as for many months the ADP has been underestimating the NFP reading. It’s also worth noting that the NFP reading falls within a “plateau” in terms of monthly employment changes. There is no visible trend, as was the case in 2021, 2022, and the first part of 2023. It resembles more the pre-COVID years, where readings fell in the range of 150,000-250,000. Currently, this range is just below.

Strong Wage Growth

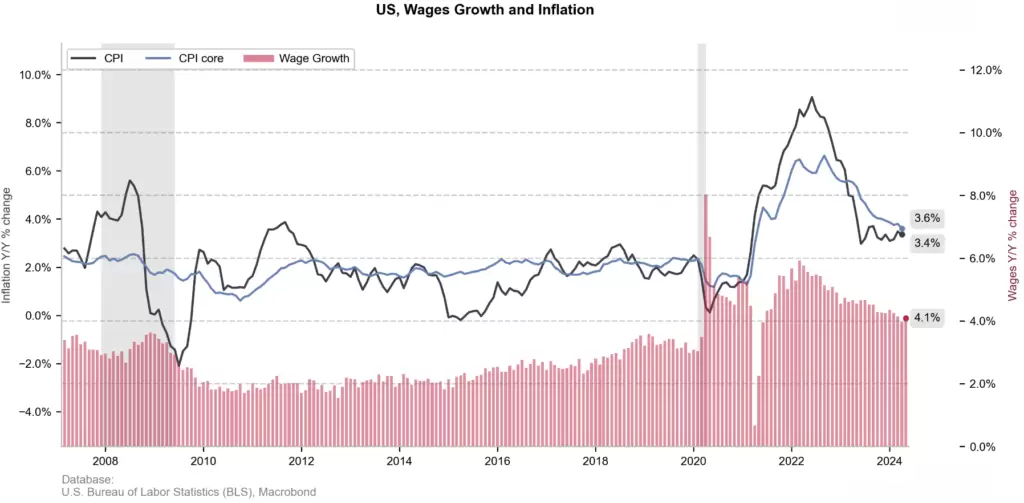

While employment growth does not necessarily translate into greater inflationary pressure, wage growth certainly has a positive impact on price growth. After several months of continuous declines, we are observing a significant recovery in the dynamics of wage growth. On an annual basis, we see a recovery to 4.1% year-on-year, compared to 3.9% year-on-year. On a monthly basis, this dynamic is already at 0.4% month-on-month, compared to the previous reading of 0.2% month-on-month. Although the wage trend remains downward, the dynamics are moving away from the desired level of +/- 3.0% annually, which would be consistent with the Federal Reserve’s inflation target. New readings above 4% could alter the perception of the restrictiveness of monetary policy, especially since the Fed places great emphasis on core inflation.

Decrease in Job Demand?

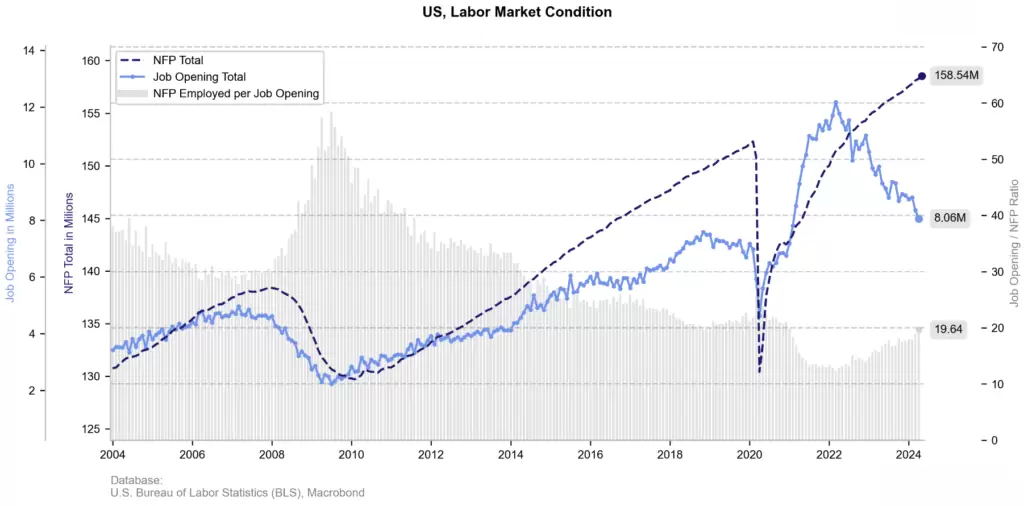

It is also worth mentioning another issue. The latest JOLTS report revealed another significant decline in job openings. Job openings fell to about 8 million. This value is much lower than the peak of 12 million but higher than the pre-pandemic level of about 6-7 million. On the other hand, looking at the 2010-2020 trend, the current number of vacancies seems relatively small, but employment continues to increase. While there may be a slight cooling in the labor market, it is certainly not a cooling that could lead to an employment collapse.

Higher Unemployment Rate

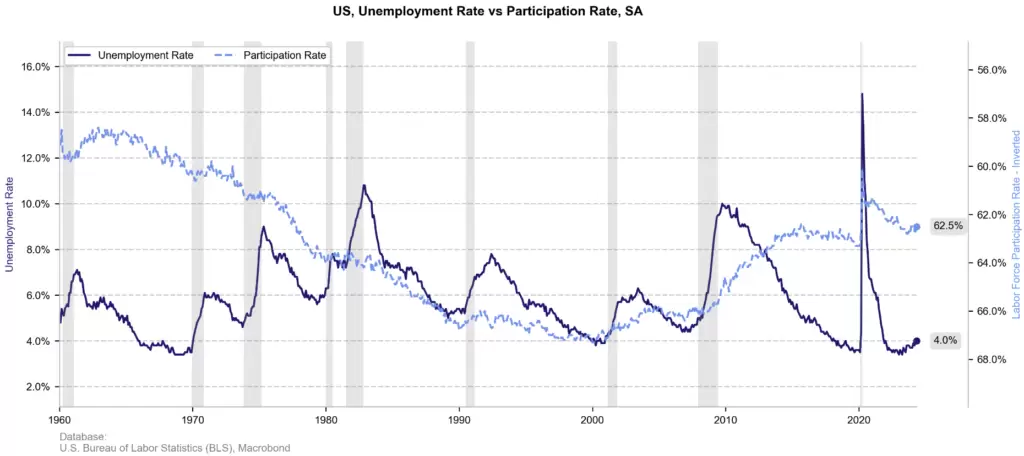

Interestingly, amid all this, the unemployment rate has recovered to 4.0%, which is the level expected by the Fed. However, the labor force participation rate fell by 0.2 percentage points to 62.5%. This is not a sign of recession, but it is noteworthy.

Significant Discrepancy in Reports

There has been talk for some time about a significant discrepancy between the NFP report (business surveys) and the household survey report (from which the unemployment rate is obtained). According to the household survey, employment decreased by more than 400,000 in May! It is worth remembering that the NFP report is the result of a model where the birth-death adjustment factor plays an increasingly significant role. However, the disparity is very large. On one hand, we have a very strong labor market, with another strong increase in employment and wage growth, and on the other hand, a significant decline in the number of employed persons. What better reflects the state of the economy?

What Does the Report Mean for the Federal Reserve?

If it weren’t for the wage growth, the report likely wouldn’t have changed the perception of the labor market much. The Fed looks at many indicators, but even if we saw a decline in employment in the June NFP report, a rate cut in July is practically impossible. September is likely still in play, although it depends on inflation readings. However, the report is likely to lead to a sustained recovery in bond yields, which will remain elevated in the long term. It is likely that the Fed will make significant changes to the projected interest rates (dot plot), which could impact Wall Street and the US dollar.

The U.S. Dollar Index (USDIDX) defended an important support area at 104.00. If yields return to the 4.5% level or higher, testing the 105-106 levels in the next 4-8 weeks cannot be ruled out.