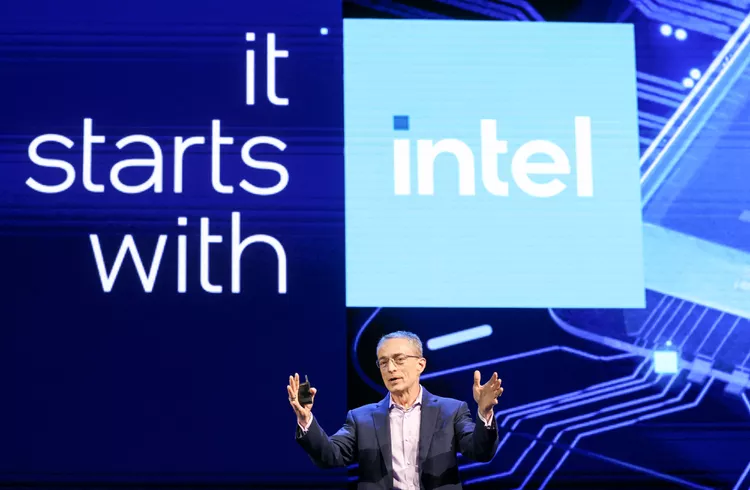

Intel shares surged in extended trading Monday after CEO Pat Gelsinger offered an update on the company’s turnaround plans.

Intel’s stock surged in extended trading on Monday after CEO Pat Gelsinger provided an update on the company’s efforts to cut costs and revitalize its business. Gelsinger shared that Intel has made significant progress through a series of cost-saving measures, including layoffs, downsizing its real estate portfolio, and selling part of its stake in the Altera programmable chip unit. These moves come as Intel strives to improve its financial position and investor confidence.

A key part of Intel’s strategy involves turning Intel Foundry, its chip production division for external clients, into a separate subsidiary. The move aims to provide Intel Foundry with greater independence, better access to financing, and optimized capital structuring, boosting its ability to compete in the global semiconductor market. Speculation had previously surfaced about a potential sale of Intel Foundry, but Gelsinger’s announcement solidified the company’s commitment to its future.

In addition, Intel secured two major deals to produce custom chips: one with Amazon Web Services (AWS) and another with the U.S. military. Gelsinger highlighted these agreements as milestones in Intel’s journey to building a world-class foundry business. He also reaffirmed the company’s commitment to expanding chip production facilities in Arizona, Oregon, New Mexico, and Ohio, positioning Intel to scale up its global production capabilities based on market demand.

After this announcement, Intel’s shares jumped over 8% in after-hours trading, adding to a 6% rise during the regular session. Despite these gains, Intel’s stock remains down more than 50% year-to-date.