Gold prices have reached a new all-time high, driven by expectations of a lower interest rate environment and increasing demand for safe-haven assets. In contrast, base metals such as copper remain weak, largely due to sluggish economic growth in major economies, particularly from China.

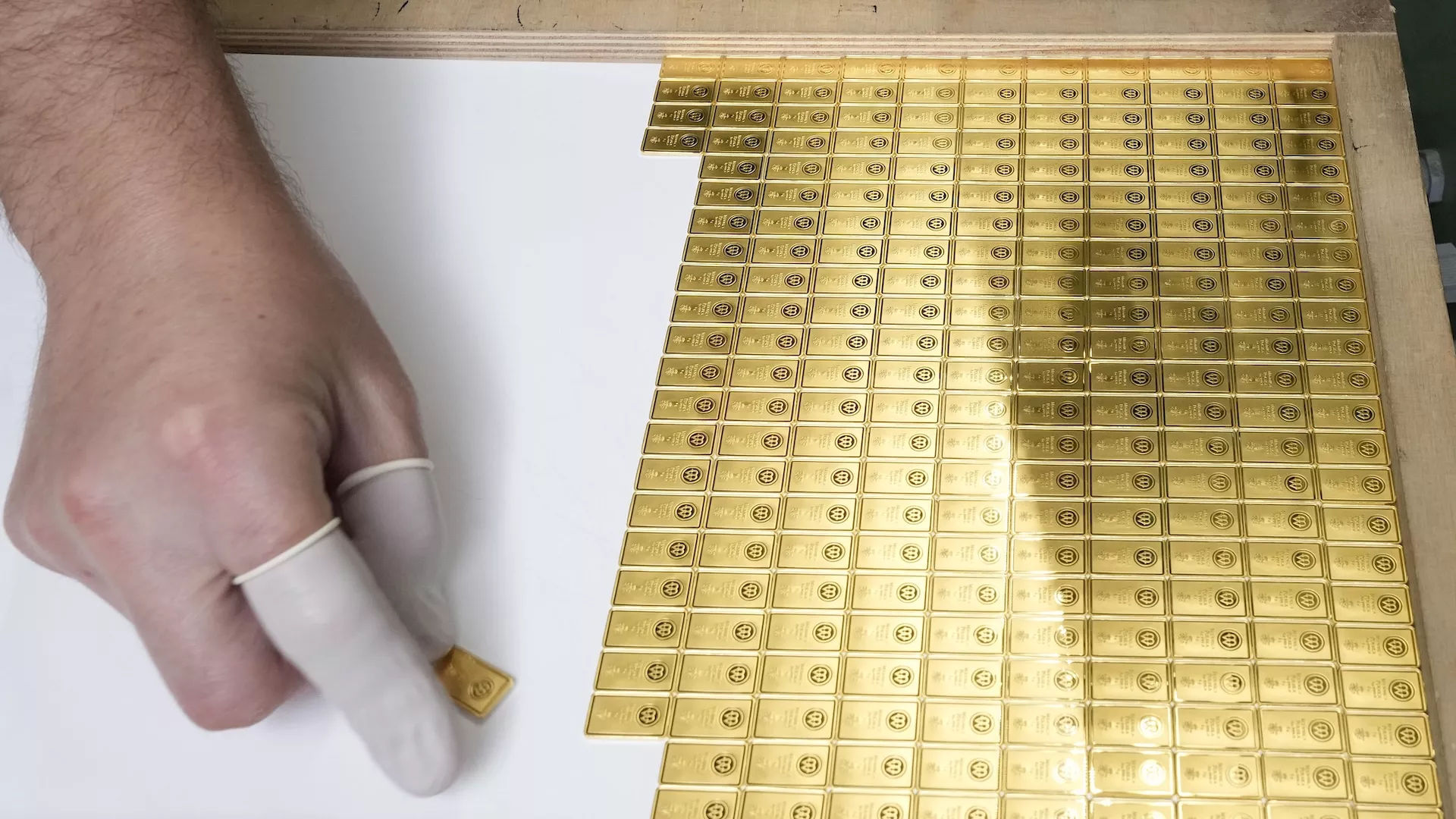

Both spot gold and futures prices surged to a new record on Friday, amid growing expectations that central banks will commit to rate cuts for the remainder of the year. The spot gold price surpassed $2,500 (€2,264) per ounce for the first time in history, while gold futures climbed above $2,540 per ounce on the final trading day of last week. Prices have been hovering around similar levels during the Asian session on Monday.

In contrast, base metals, such as copper, have remained weak due to economic concerns. The copper futures price plunged to a five-month low of $3.93 (3.56) per pound in early August before experiencing a mild rebound to $4.18 (€3.79) per pound on Monday, driven by sluggish demand in China.

Over the past three months, gold futures have risen by 5%, while copper futures have declined by 18%. The recent divergence in trends between gold and copper suggests that investors are seeking safe-haven assets while offloading growth-driven commodities, amid concerns about the global economy.

Gold price surge driven by macro forces

The macro-economic backdrop indicates that central banks are on course to loosen monetary policies due to softening consumer prices and slowing economic growth. Gold prices are inversely correlated with the value of the US dollar and interest rates.

First, as gold is priced in US dollars, a weaker dollar makes gold less expensive in other currencies, thereby increasing demand for the precious metal. Secondly, lower interest rates make interest-bearing assets, such as cash, less attractive, while gold becomes more appealing as a store of value.

The catalyst for the surge in gold prices may have been the disappointing US property market data released on Friday, which showed that housing starts slumped 6.8% to a four-year low and housing permits fell for the sixth consecutive month in July.

The disappointing data has further reinforced the likelihood of the Federal Reserve commencing rate cuts in September and beyond.

Last week, both the UK and the US released cooler-than-expected inflation data for July, encouraging signs of a lower interest rate environment in these major economies.

Additionally, the Reserve Bank of New Zealand unexpectedly delivered its first rate cut since the pandemic. The bank anticipates more cuts this year, having dramatically shifted its tone from the last meeting due to the rapidly deteriorating domestic economy.

Furthermore, safe-haven demand has also bolstered gold prices amidst ongoing military conflicts in the Middle East and the war between Ukraine and Russia.

China’s role in shaping copper prices

China, as both a significant supplier and consumer of copper, plays a pivotal role in shaping trends within the critical metals market.

The price surge in copper earlier this year was driven by China’s reduction in production, prompted by a sharp decline in copper treatment charges.

However, tepid economic data from China in recent months, coupled with global market turmoil amidst fears of a US recession, sent copper prices to a five-month low on 8 August.

Despite a recent recovery in market sentiment, which has led to a rebound in copper prices over the past week, the ongoing sluggishness in China’s property sector is expected to continue weighing on demand. A weakening US dollar may, however, help to offset some of this decline.

In the long term, copper is likely to remain in an uptrend. It is a critical resource for renewable energy, electric vehicles (EVs), and artificial intelligence (AI) technologies.

S&P Global has forecast that copper demand will double, reaching 50 million metric tons by 2035, with the most significant demand expected to come from the US, China, Europe, and India.