Euro area private sector activity grew in June, surpassing earlier estimates and showing robust recovery. Activity in Spain showed the strongest growth, while contractionary conditions held in France amid election uncertainties.

Private sector activity in the euro area expanded in June, surpassing previous estimates, indicating that the recovery phase is well on track, though with significant variations among member countries.

The seasonally adjusted Hamburg Commercial Bank (HCOB) Eurozone Composite PMI Output Index – which reflects conditions in both the services and manufacturing sectors – came in at 50.9, marking the fourth consecutive month above the 50.0 no-change mark. This is a slight decline in the pace of expansion compared to May’s 52.2 but marginally better than the initial estimates of 50.8.

The upward adjustment is due to the revision in the expansion rate in the services sector, with the HCOB Eurozone Services PMI at 52.8 in June, against the previous estimate of 52.6, but down from 52.3 in May. That said, it marks the fifth straight monthly expansion in the services sector.

“Growth in the Eurozone can be attributed fully to the service sector”, Dr Cyrus de la Rubia, chief economist at HCOB, commented.

According to de la Rubia, the eurozone service sector benefits from a high volume of tourists. The New Export Index, which includes tourism, has been rising steadily for six months and is now almost two points above its long-term average.

The European Central Bank (ECB) reduction in interest rates in June finds some justification in the dynamics of the HCOB Services PMI price indices. Input prices and prices charged to clients increased at the slowest rate in three years.

Almost all of the eurozone nations with composite PMI data available recorded growth during June, with the notable exception of France.

Spain leads growth, buoyed by tourism and interest rate outlook

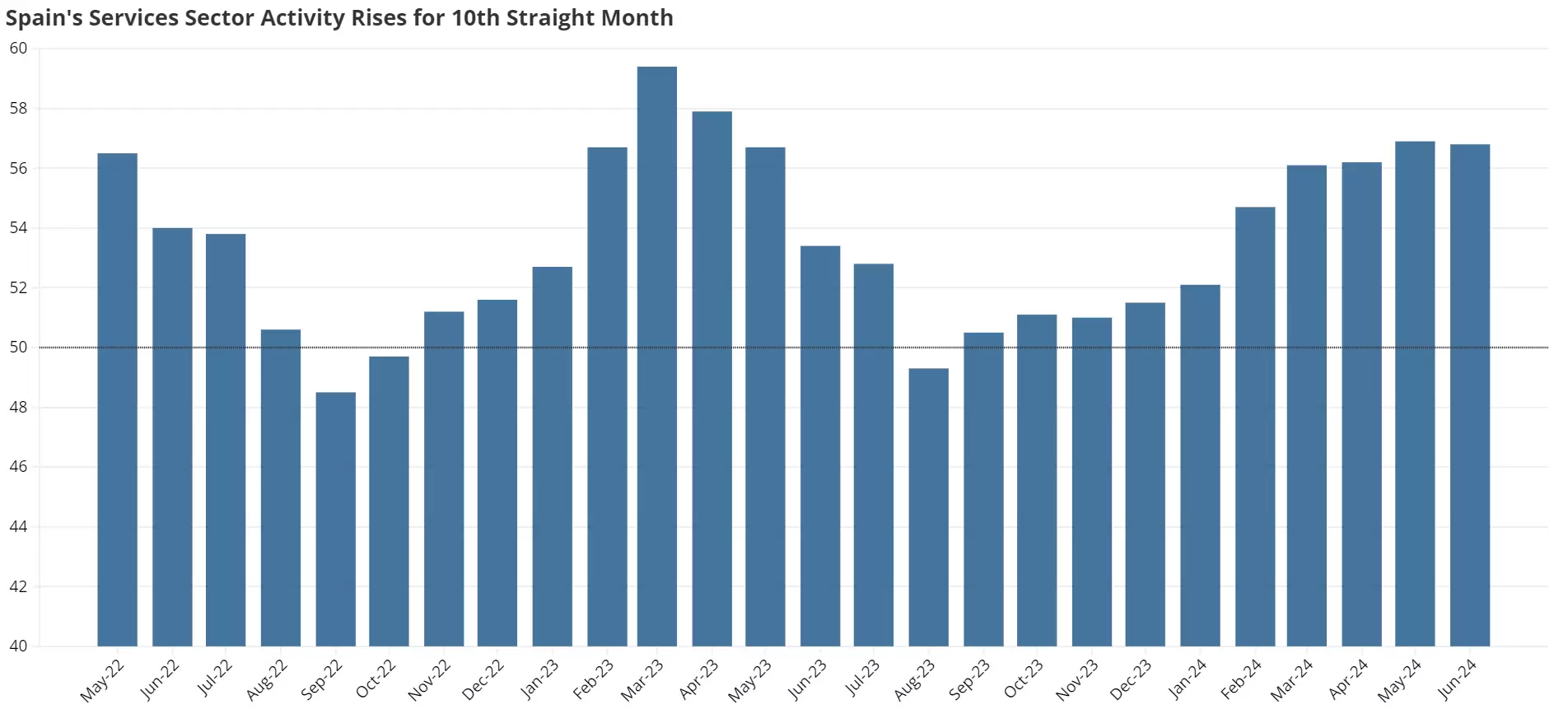

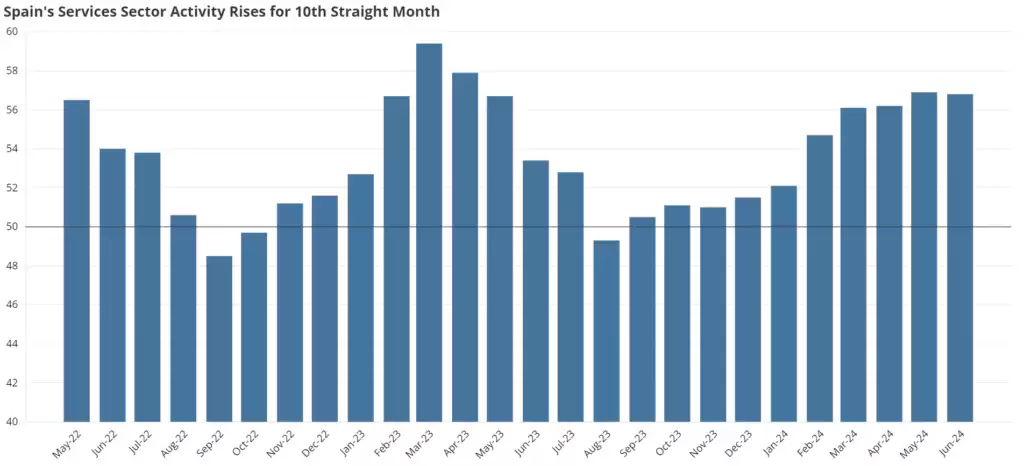

Spain continued to be the fastest-growing economy in the eurozone, with output rising sharply, likely driven by a strong tourism season and an improving outlook on interest rates.

The HCOB Spain Services PMI was 56.8 in June, revised upwards from 56.4 in the previous estimate and only slightly below May’s 13-month high of . This marks the 10th consecutive month of expansion in Spain’s service sector, supported by robust demand from both domestic and international clients.

Employment in Spain increased for the 21st consecutive month at a quicker pace as companies expanded their workforce to meet current and expected demand. However, this increase in employment also resulted in higher wage levels in June.

“Some panellists believe that activity is still going to increase due to lower inflation and interest rates in a year’s time”, said Jonas Feldhusen, junior economist at HCOB.

Feldhusen anticipates that growth will be above the historical average in the second quarter, following strong GDP revisions from the previous two quarters.

France’s private sector activity contracts amid election turmoil

France was an outlier, with private sector business activity weakening for the second consecutive month.

The HCOB Composite PMI Index in France showed slight improvement from the previous month but remained below 50, indicating contraction.

“Upcoming elections have made service providers less optimistic about future activity. In addition to business confidence being at a five-month low, it is also clearly below its historic average. In accordance with this, employment growth weakened”, said Norman Liebke, economist at HCOB.

According to Liebke, the upcoming elections appear to be a significant factor, particularly as new orders have abruptly declined. French service companies have been working through backlogs in response to weaker demand, explaining the discrepancy between the indices for output and new orders.

Moreover, although inflation in French service prices is gradually easing, it remains a concern due to the recent historically high surge in input prices, with companies reporting increased salary costs and higher raw material prices.