The ECB is cautious on potential rate cuts, emphasising flexibility ahead of the 12 September meeting. Policymakers highlight uncertainty in the economic outlook and the need for data-driven policy decisions.

The European Central Bank (ECB) is treading carefully on potential interest rate cuts, opting to approach its September meeting with an open mind and guided by a broad evaluation of forthcoming economic data.

Essentially, it shouldn’t be taken for granted that a rate cut will be delivered at the 12 September monetary policy meeting in Frankfurt, in stark contrast to market expectations, which largely anticipate a rate reduction next month.

This cautious stance is detailed in the recently published account of the ECB’s monetary policy meeting held on 17-18 July 2024.

The document reflects a sense of caution among members of the Governing Council, who are wary of making premature commitments to a specific rate trajectory.

“There should be no pre-commitment to a particular rate path, given the uncertainty surrounding the pace at which inflation will return to target,” the account notes.

This reflects the Governing Council’s consensus that flexibility is crucial in the current economic environment, as the path of inflation remains uncertain.

Gradual policy adjustment favoured

The ECB’s account also reveals that a cautious approach would enable Frankfurt to respond more gradually if inflation proves to be more persistent than currently expected.

“The Governing Council could afford to be patient and wait for more data to confirm that disinflation was indeed on track,” the document adds.

Members indicated that the September meeting is viewed as an opportune moment to reassess the level of monetary policy restriction, but while data dependency remains key, it should not translate into an overemphasis on individual data points.

Resilience of service inflation and stagflationary concerns

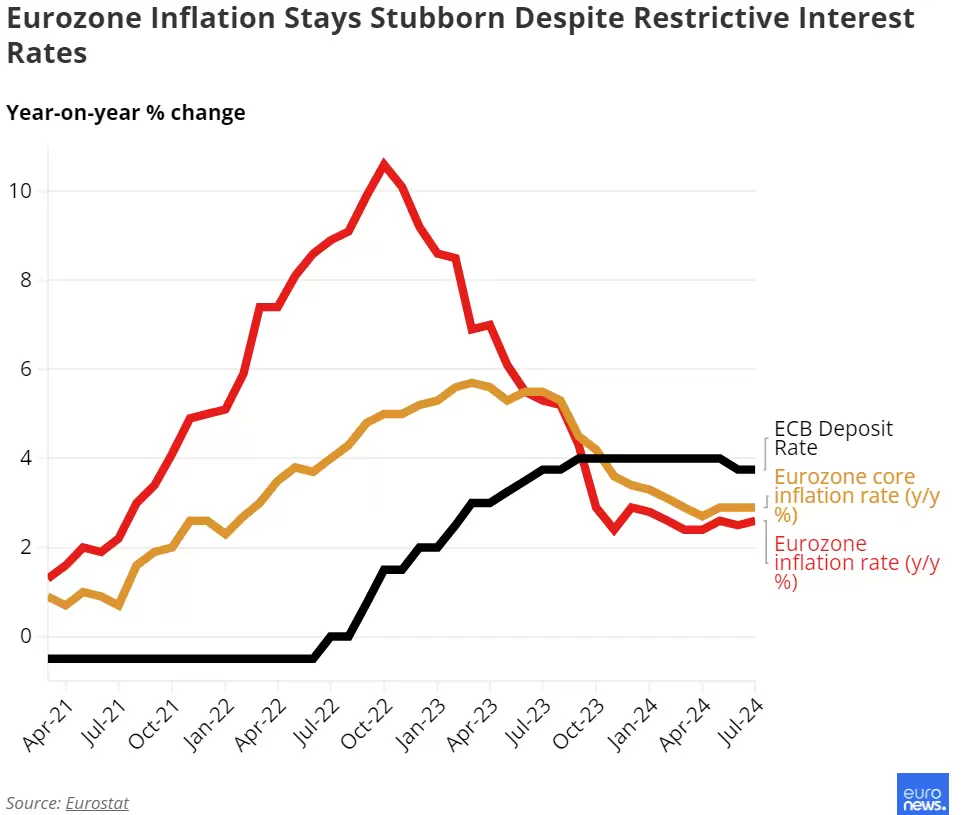

The most recent data highlighted that inflation has been more resilient than anticipated, even as economic activity indicators have underperformed.

Members noted that “the short-term outlook had thus become somewhat more ‘stagflationary'”, with growth risks skewed to the downside.

Members pointed out that the short-term outlook for growth has deteriorated, as evidenced by both soft and hard data, including weak manufacturing PMI indicators. The economy remains unbalanced, with the recovery predominantly driven by the services sector.

Despite these challenges, the labour market continues to display resilience. The unemployment rate held steady at 6.4% in May, its lowest since the inception of the euro, reinforcing expectations that a soft landing for the economy might be in the cards.

Political uncertainty continues to weigh on decisions

Fiscal policy also emerged as a point of concern, with policymakers wary that political uncertainty and shifts in governments across the eurozone could lead to less fiscal consolidation than previously expected.

Inflation is forecast to hover around current levels for the remainder of the year, partly due to base effects related to energy prices, before gradually declining towards target in the second half of next year and stabilising around 2% by 2026.

The Governing Council underscored the persistence of services inflation as a central factor in shaping the overall inflation outlook.

Services inflation has remained stubbornly high, hovering around 4% since late 2023, with core inflation also showing resilience. Upside risks to inflation persist, especially if wages or profits rise more than expected, or if geopolitical tensions push energy prices higher.

In light of these factors, members concluded that a cautious policy response is warranted as inflation only gradually recedes. The continued strength in services demand and profits suggests that the transmission of monetary policy to the most inflationary sectors of the economy remains limited, necessitating a measured approach from the ECB.

Market reactions

The euro held steady against the dollar following the release of the ECB’s account. The single currency traded at 1.1130 against the greenback at 14:00 CET, close to the 13-month high reached during Wednesday’s session, which marked the fourth consecutive day of gains.

Eurozone equities had a relatively quiet session on Thursday, with the broader Euro Stoxx 50 index edging up by 0.2%. Among the top gainers were Deutsche Bank, up 3.1%, and Inditex, up 1.8%.

The Spanish IBEX 35 Index outperformed, rising 0.8%, while both the DAX and the CAC 40 gained 0.2%. The Italian FTSE MIB remained flat.