Shares of Warren Buffett’s holding company, Berkshire Hathaway, rose in intraday trading on Wednesday, pushing its market capitalization above $1 trillion for the first time. Berkshire is now the 8th U.S. company and the 9th globally to reach this significant milestone.

Under Buffett’s leadership over the past six decades, Berkshire Hathaway has evolved into a financial and industrial powerhouse, with an equity portfolio valued at nearly $300 billion. The company’s methodical approach to business and investments has been key to its success, making it one of the most respected names in the financial world.

Berkshire Hathaway’s journey to the $1 trillion mark has been the longest among U.S. companies to reach this figure. The company’s origins date back to the 19th century in the textile industry, with the name Berkshire Hathaway emerging from the 1955 merger of Berkshire Fine Spinning Associates and Hathaway Manufacturing Company.

Warren Buffett began building a stake in the struggling textile firm in 1962, eventually taking control in 1965. He quickly diversified the company’s operations, acquiring its first insurance business, National Indemnity Company, in 1967. This move set Berkshire on the path to becoming a financial giant. Over the years, Buffett expanded the portfolio with strategic acquisitions, including BNSF Railway, Duracell, and Dairy Queen.

Buffett, along with his business partner Charlie Munger, continued to grow Berkshire’s equity portfolio, focusing on undervalued companies. By the end of the second quarter, Berkshire’s portfolio was valued at $284.9 billion, including significant holdings in Apple ($84 billion) and Bank of America ($41 billion), with unrealized gains comprising nearly $200 billion.

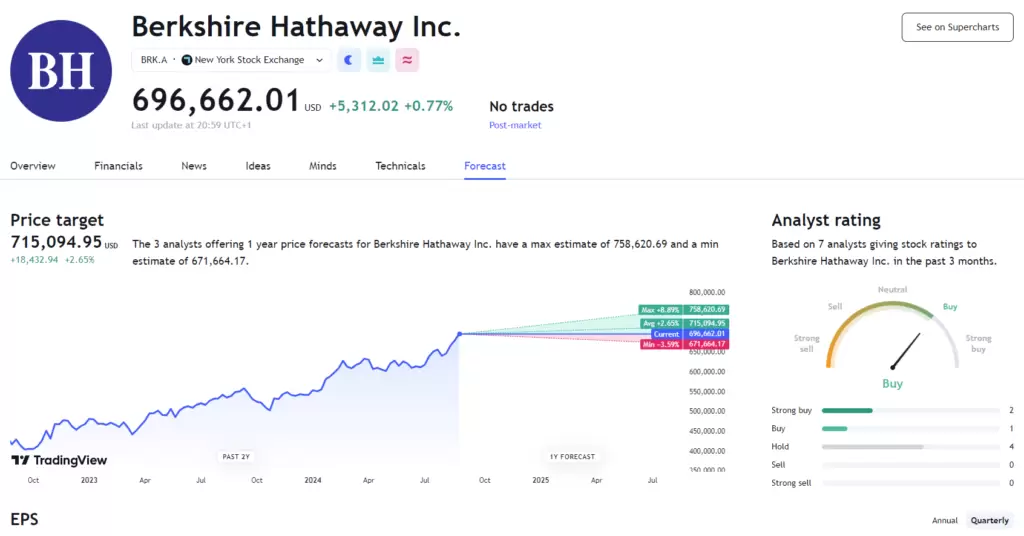

As of Tuesday, Berkshire’s market cap stood at about $995 billion, requiring a slight gain of 0.5% to surpass the $1 trillion mark. However, due to the company’s unique dual-class share structure, it’s challenging to pinpoint the exact price needed for Berkshire to close above $1 trillion. The liquidity differences between Berkshire’s Class A and Class B shares further complicate this calculation. By Wednesday afternoon, Class A shares had risen 0.33%, while Class B shares were up 0.41%, reflecting the stock’s movement towards the historic milestone.