Shares of Advanced Micro Devices tumbled Thursday as the chipmaker’s new AI lineup failed to excite investors who are eager to see the company take on Nvidia.

Shares of Advanced Micro Devices (AMD) tumbled 4% on Thursday as the chipmaker’s newly unveiled AI lineup failed to generate excitement among investors eager to see AMD directly challenge Nvidia (NVDA) in the booming AI market. Analysts speculated that investors were hoping for clearer signs of increased competition, an outlook boost, or a major new customer announcement, but AMD’s presentation left those expectations unmet.

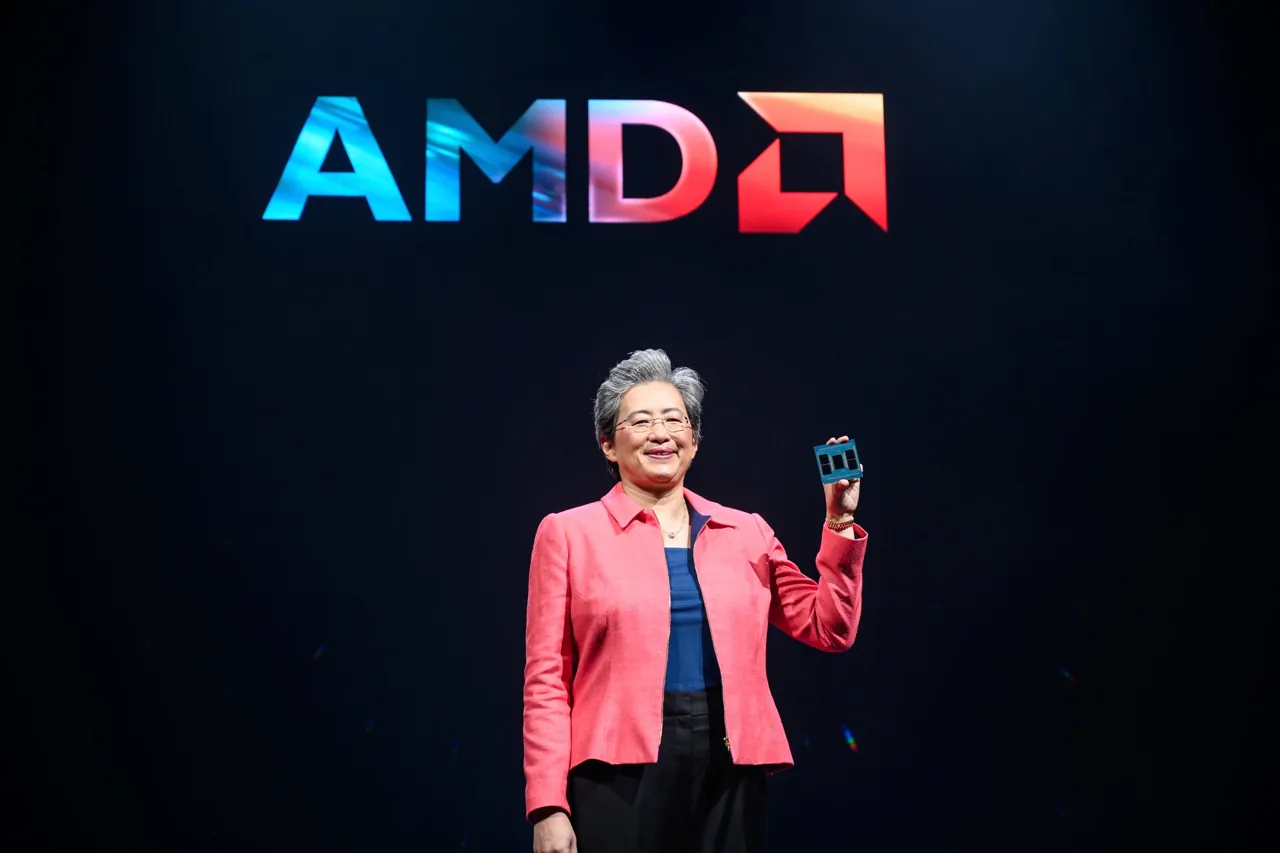

AMD’s next-generation AI products were introduced at the company’s “Advancing AI” event, highlighting its ambition to capture a larger share of the soaring AI chip demand. Despite these efforts, the stock faced selling pressure, particularly near the upper trendline of a descending channel that’s been forming since March. Thursday’s drop occurred on the heaviest trading volume since the early-August selloff, suggesting strong conviction behind the downward move.

So far this year, AMD shares have gained 11%, trailing the S&P 500’s performance by roughly half, as concerns persist that the company may not fully capitalize on the lucrative AI infrastructure boom in the way Nvidia has.

Technical Breakdown and Key Levels to Watch

AMD’s stock has been oscillating within a descending channel since hitting an all-time high (ATH) in March. This pattern of lower highs and lower lows suggests bearish sentiment, and the stock has recently struggled near the upper trendline of this channel. Additionally, a death cross formed in August, where the 50-day moving average (MA) crossed below the 200-day MA—a bearish signal forecasting potential lower prices.

If the stock continues to pull back, investors should watch three critical support levels. The first is around $162, just below Thursday’s close at $164.18, which aligns with the 200-day MA and trendline support from earlier this year. Should the stock break through this, it could fall to $142, where previous consolidation in late 2023 and a prominent trough in May suggest possible buying interest. A deeper correction might push the stock to $122, a key level near the channel’s lower trendline and a region that coincides with the early-August low.

Upside Target

Despite the current downtrend, there is an upside price target of $220 if AMD can break above the descending channel. Using the measuring principle—a technical method that projects a price move based on the distance between trendlines—adding $50 to $170 gives a potential target of $220, just shy of AMD’s all-time high of $227.30.

Investors will continue to closely monitor AMD’s technical levels and market moves as the company navigates competition in the rapidly growing AI sector.